at-time.ru

Community

State Farm Roadside Number

If you need help with anything, you can talk with your State Farm agent or call one of our Customer Care representatives at STATE-FARM ( Been in an accident and need roadside help? Give us a call at or view Accident Help. Roadside Assistance · Home & Property · Home · Condominium · Renters © Copyright , State Farm Mutual Automobile Insurance Company, Bloomington, IL. State Farm's emergency roadside assistance covers services like towing, lockouts, and fuel delivery. However, you may need to pay for delivered items like a new. File a claim online, use our easy State Farm® mobile app, or call us at SF-CLAIM (). Notify your insurance agent as soon as. If you already have Roadside Assistance coverage on your Indiana Farm Bureau Insurance policy, simply call () for prompt personal service. Roadside. Emergency road service. 24/7 Phone line. Get helpLearn more about roadside service. Pay insurance. 24/7 Phone line. With the award winning State Farm mobile app, you can manage your insurance and other products, request roadside assistance, file and track claims, and much. State Farm Roadside Assistance available 24/7; Assistance is more than towing and jump-starts; Price of State Farm Roadside Assistance. Roadside. If you need help with anything, you can talk with your State Farm agent or call one of our Customer Care representatives at STATE-FARM ( Been in an accident and need roadside help? Give us a call at or view Accident Help. Roadside Assistance · Home & Property · Home · Condominium · Renters © Copyright , State Farm Mutual Automobile Insurance Company, Bloomington, IL. State Farm's emergency roadside assistance covers services like towing, lockouts, and fuel delivery. However, you may need to pay for delivered items like a new. File a claim online, use our easy State Farm® mobile app, or call us at SF-CLAIM (). Notify your insurance agent as soon as. If you already have Roadside Assistance coverage on your Indiana Farm Bureau Insurance policy, simply call () for prompt personal service. Roadside. Emergency road service. 24/7 Phone line. Get helpLearn more about roadside service. Pay insurance. 24/7 Phone line. With the award winning State Farm mobile app, you can manage your insurance and other products, request roadside assistance, file and track claims, and much. State Farm Roadside Assistance available 24/7; Assistance is more than towing and jump-starts; Price of State Farm Roadside Assistance. Roadside.

Been in an accident and need roadside help? Give us a call at or view Accident Help.

78 votes, comments. statefarm canceled my insurance today and they stated it's because i've used roadside assistance 5 times in 3 years. State Farm Insurance is the official sponsor of the Highway Emergency Local Patrol (HELP) traveler assistance service. The funding is used. Roadside Assistance · Home & Property · Home · Condominium · Renters © Copyright , State Farm Mutual Automobile Insurance Company, Bloomington, IL. Emergency road service insurance can provide coverage for roadside assistance, such as towing, battery jump-starts, lockout services, and tire repair. What does roadside assistance cover? · Mechanical labor at the breakdown site (up to one hour). · Towing to the nearest repair location if the covered vehicle is. Roadside assistance also covers one hour of on-scene repair work by a mechanic or a technician. It's intended for minor problems that can be fixed on the spot. Car replacement Glass Repair and Towing, Labor. Roadside Assistance provides towing service to the location of your choice ; CustomFit: customized coverage. With the State Farm® mobile app, you can manage your insurance and other products, request roadside assistance, file and track claims, and much more. Still need help? Call SF-CLAIM ( )SF-CLAIM ( ) and we will be happy to assist. Log in. I saw a post on legaladvice where someone was having this issue with State Farm and it reminded me of having the same issue with them years ago. File a claim online, use our easy State Farm® mobile app, or call us at SF-CLAIM (). Notify your insurance agent as soon as. Battery Jump Start; Tire Change; Towing; Locksmith; Refueling. One Call and Help is on the Way. To request emergency roadside assistance, simply call toll. Put convenience at your fingertips with our State Farm mobile app. This app helps you access your insurance card, start a claim, call for roadside assistance. Battery; Fuel; Tire servicing; Locked out; Repairs. Narrator: If you'd like to learn more about Emergency Roadside Service, or other car coverage options, your. You can start the claim process immediately at the scene and add details when things are calmer. · File a claim online, use our easy State Farm® mobile app, or. AAA roadside assistance costs, State Farm is cheaper by far. Our research shows State Farm's roadside assistance add-on can cost about $30 per year (though. Make sure your receipt or invoice includes your vehicle's year, make, model, and VIN. · Reach out to Roadside Assistance number through Contact our service provider at Emergency roadside service FAQs. Farmers roadside assistance can help. Provide some limited information List of all insurers and states where licensed at at-time.ru Farm Bureau of Michigan policy holders with Roadside Assistance coverage are eligible for service. What's Included.

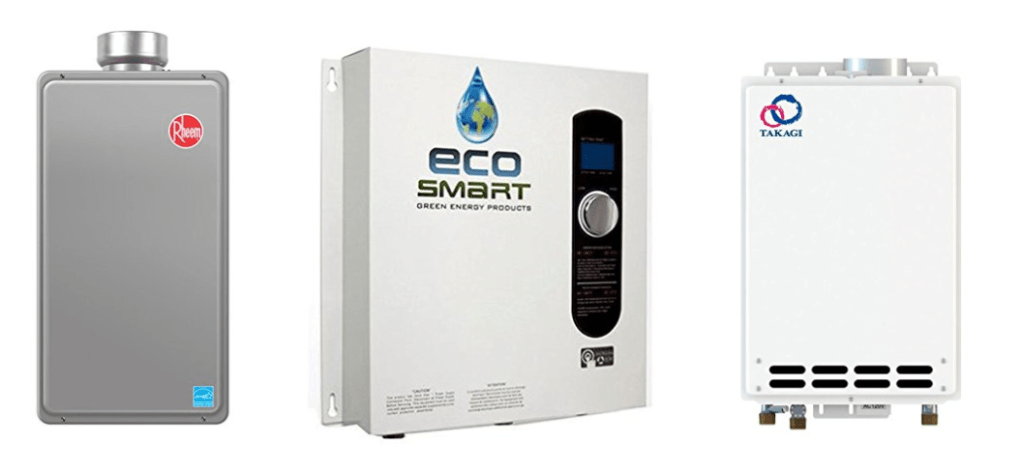

Tankless Water Heater Ratings 2020

2. Tankless water heaters save space. Tankless units typically occupy 40–60% less space than comparable tank units, according to Fenske, who also conducts. Tankless water heaters are energy-efficient, have low maintenance costs, and are reasonably durable. But just like any appliance, they're not completely. They say that it's useless, not worth the money and that it didn't heat the water past 50 degrees. AI-generated from the text of customer reviews. Select to. Testimonials · Excellent heater. "Excellent heater. Instalation realy easy, just follow instruccions. · Great product. "Easy installation with very good and clear. Drain valves for emptying shall be installed at the bottom of each tank-type water heater and hot water storage tank. rated assembly or removing. December 29, You may not realize how much a water heater can impact Our technicians have years of experience and can help you decide on the type. tankless water heater. January 01, |. By The Water Heater Company Every tankless water heater has a flow rate capacity that should give you a good. U.S. Tankless Water Heater Market size, by type, - (USD Million rating of 99%, which means that 99% of the electricity utilized for heating. best heat pump water heater and our reviews of the best tankless water heater. Between July and January , the average price of the water heaters. 2. Tankless water heaters save space. Tankless units typically occupy 40–60% less space than comparable tank units, according to Fenske, who also conducts. Tankless water heaters are energy-efficient, have low maintenance costs, and are reasonably durable. But just like any appliance, they're not completely. They say that it's useless, not worth the money and that it didn't heat the water past 50 degrees. AI-generated from the text of customer reviews. Select to. Testimonials · Excellent heater. "Excellent heater. Instalation realy easy, just follow instruccions. · Great product. "Easy installation with very good and clear. Drain valves for emptying shall be installed at the bottom of each tank-type water heater and hot water storage tank. rated assembly or removing. December 29, You may not realize how much a water heater can impact Our technicians have years of experience and can help you decide on the type. tankless water heater. January 01, |. By The Water Heater Company Every tankless water heater has a flow rate capacity that should give you a good. U.S. Tankless Water Heater Market size, by type, - (USD Million rating of 99%, which means that 99% of the electricity utilized for heating. best heat pump water heater and our reviews of the best tankless water heater. Between July and January , the average price of the water heaters.

Compare ENERGY STAR Certified Heat Pump Water Heaters, find rebates, and learn more. Backed by long-term warranties for residential and commercial use, our tankless water heaters are a safe bet to product on demand hot water. Therefore, a water heater would be required which will recover GPH. F. To compute a BTU or KW rating for the required hourly hot water demand found in. good websites that will walk you through the “math” tp size the model water. 1 Like. jawa August 30, , am # My husband's office went with. It was easy to install and performs flawlessly. Plenty of hot water for two people in a two-bath home. An excellent value. add_circle_outline How do I know if an electric or gas tankless water heater is best for me? © , State Industries. All Rights Reserved. State. Tankless takes longer to heat up. A tank provides hot water very quickly, but tankless has to light, warm up the water, and then deliver it. It. Find residential and commercial tankless models, hybrid heat pumps and storage tanks. Explore A. O. Smith's line of gas and electric water heaters. , AM After all of these years, why hasn't anyone invented a good way to drain the water heater without it spilling all over the place? For homes that use 41 gallons or less of hot water daily, demand water heaters can be 24%–34% more energy efficient than conventional storage tank water heaters. Therefore, a tankless water heater has a longer life expectancy and a lower corrosion rate than a conventional water heater. Top brands for tankless water. When we first published this review in , AO Smith's heat pump water heaters tied Rheem for the cheapest model. Tankless Water Heater Reviews. Home heating. Rinnai tankless water heaters last up to twice as long, have twice the warranty, and save energy as they only heat water when it is needed. Tankless vs. Tank Water Heaters: Hot Water Showdown Choosing between a tankless and tank water heater depends on your priorities and hot. Tankless water heaters are known for being much more efficient and smaller in terms of their size. Many people think tankless is a better choice. Tankless water heater information. Tips, Buyer Guides and step by step 'How to' guides for repairs and maintenance. Eemax Tankless Electric Water Heaters offer Handwashing Solutions for Healthcare Settings. Waterbury, CT (January ) — Eemax has been evolving hot water for. Tankless Water Heaters, by capacity in gallons. CALIFORNIA ENERGY COMMISSION First Hour Rating. Uniform Energy Factor. Page 2. Consumer Electric. Water Heater Reviews · 6 Best Electric Tankless Water Heater, Plus 2 to Avoid ( Buyers Guide) | Freshnss · 9 Best Electric Water Heater Reviews, Plus 1 to.

Is It Good To Rent To Own

As a seller, the rent-to-own model can be a good option if your house has been on the market for a while and you haven't been able to find a buyer. Or, perhaps. rent personal property to a renter under a rent-to-own agreement. General duty: The lessor must maintain the rental property in good working. Buyers in rent to own deals are far less protected. When a problem develops, the buyer loses. If these things are so. Possible disadvantages of a rent-to-own contract include: In some cases, you might be better off renting. As a renter, you can spend time saving money or. Pros and Cons of Rent To Own Homes in NYC · 1. More Potential Buyers · 2. Maximize Income · 3. The Vested Interest of the Tenant · 1. Financial Loss · 2. Long. You might think it sounds too good to be true, but that's exactly what rent-to-own homes in Florida offer. This unique approach to home ownership allows you to. It is always better to own because then you have something that is yours and can be used as an asset but renting can have its benefits too. It takes time to save enough money to buy a home. Rent is one of the largest household expenses, and right now, there are few options for people to leverage the. Rent-to-own allows potential buyers to build up rent credits toward the total price, which may make it easier to get a good rate on an eventual mortgage. As a seller, the rent-to-own model can be a good option if your house has been on the market for a while and you haven't been able to find a buyer. Or, perhaps. rent personal property to a renter under a rent-to-own agreement. General duty: The lessor must maintain the rental property in good working. Buyers in rent to own deals are far less protected. When a problem develops, the buyer loses. If these things are so. Possible disadvantages of a rent-to-own contract include: In some cases, you might be better off renting. As a renter, you can spend time saving money or. Pros and Cons of Rent To Own Homes in NYC · 1. More Potential Buyers · 2. Maximize Income · 3. The Vested Interest of the Tenant · 1. Financial Loss · 2. Long. You might think it sounds too good to be true, but that's exactly what rent-to-own homes in Florida offer. This unique approach to home ownership allows you to. It is always better to own because then you have something that is yours and can be used as an asset but renting can have its benefits too. It takes time to save enough money to buy a home. Rent is one of the largest household expenses, and right now, there are few options for people to leverage the. Rent-to-own allows potential buyers to build up rent credits toward the total price, which may make it easier to get a good rate on an eventual mortgage.

You will have the right to purchase the property, either during your lease or once your lease expires. However, you are not forced to purchase. This can range. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential owners need to think about how long they will. Under an executory contract (rent to own) the buyer has the right, but not the obligation, to complete the purchase. See Bryant v. Cady, S.W.3d , Is It Better to Rent or Own a Home? There is no definitive answer about whether renting or owning a home is better. The answer depends on your own personal. The main reason is that they are able to justify higher rent. If a house should rent for $, they rent it $, but say $ a month goes towards the. Rent-to-own can be an amazing option for people who want to make a move from renting to buying but still need time to save enough money or build credit. But if you can negotiate a lower monthly rent credit and be disciplined to save the difference on your own, that would be a better deal. That's because if you. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential owners need to think about how long they will. Usually, co-ops are frequently offered as rent-to-own homes though you may find condos as well. The chief reason behind such an offer is that when a particular. A rent-to-own agreement, also known as a lease to purchase and a lease option, is a real estate agreement that is a combination of a rental lease and a. Here's what can work well for those who choose to rent-to-own. There's more time to build a down payment. Sometimes, the only thing between you and. Rent-to-own home buyers can avoid the need to secure a mortgage by paying the seller directly. This is especially helpful if the buyer is unable to secure. A rent-to-own agreement can benefit both buyers and sellers. It provides a potential route to homeownership for tenants who might not easily qualify for a. This is known as a “Rent Credit”. You will have the right to purchase the property either during your lease or once your lease expires, however you are not. A 'Rent to Own' program, also known as a lease-to-own or rent-to-own agreement, is a housing arrangement that combines elements of renting and buying a home. Rent to own is where a renter/buyer and a seller agree to a predetermined price where the buyer rents a house and has the option to purchase the house they are. A major problem with any lease-purchase rent-to-own agreement is that you may not be able to get approved for a mortgage to close the sale, and then you could. Instead of paying rent with no long-term benefits, individuals in a rent-to-own agreement have the satisfaction of knowing that part of their monthly rent. Rent-to-own programs make for a great investment because there In fact, I would have made a good candidate for a rent-to-own program back in Hong Kong. Although in principle "Rent to Own" sounds good, it's just not popular with our Maryland landlords. There are just way too many uncertainties. 1. Our landlords.

Home Loan Qualification Estimator

Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage. The True House Affordability Tool provides a prequalification, which gives you an estimate of the amount of mortgage you may qualify for with us. With our mortgage prequalification calculator, you can try different scenarios with different down payment amounts. Learn how much you might be pre-qualified for and what your monthly mortgage payments, closing costs, and monthly taxes. Get detailed and personalized. This tool can help you figure out just how much house you can afford to buy. First enter the price of a house you wish to buy and the down payment you could. A mortgage prequalification is a quick and simple way to find out how much you could borrow, and what your estimated rate and payment would be. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Use this calculator to figure home loan affordability from the lender's point of view. A table on this page shows front-end and back-end ratio requirements. Use Bankrate's loan prequalification calculator to determine your ability to qualify for a home or auto loan. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage. The True House Affordability Tool provides a prequalification, which gives you an estimate of the amount of mortgage you may qualify for with us. With our mortgage prequalification calculator, you can try different scenarios with different down payment amounts. Learn how much you might be pre-qualified for and what your monthly mortgage payments, closing costs, and monthly taxes. Get detailed and personalized. This tool can help you figure out just how much house you can afford to buy. First enter the price of a house you wish to buy and the down payment you could. A mortgage prequalification is a quick and simple way to find out how much you could borrow, and what your estimated rate and payment would be. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Use this calculator to figure home loan affordability from the lender's point of view. A table on this page shows front-end and back-end ratio requirements. Use Bankrate's loan prequalification calculator to determine your ability to qualify for a home or auto loan.

How much house can I afford? Learn the difference between a mortgage prequalification and mortgage preapproval. Prequal vs preapproval? It often depends on. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. Use this calculator as your first step in determining your ability to qualify for a loan. While this calculator can't guarantee you will qualify for your new. We follow the same guidelines lenders and brokers use to determine the maximum mortgage you can qualify for. We recommend experimenting with different mortgage. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. loan. A pre-qualification, on the other hand, is an estimate for the amount you can borrow to buy a home. Estimate your prepayment charges. If you repay your. This calculator allows you to do a "What if?" calculation based on costs you input and can help determine how much income a lender will want you to have to. Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you're in the right range. Refinance calculator. Understanding the four criteria lenders consider when qualifying a homebuyer for a mortgage will position you to become a homeowner. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Our calculator estimates what you can afford and what you could get prequalified for. Why? Affordability tells you how ready your budget is to be a homeowner. This assumes that your total costs for your loan payments (principal and interest), taxes, and insurance should not be higher than 45% of your monthly income. If you're ready to buy a home, this free mortgage prequalification calculator can help you see how much home you can afford and what down payment you need. Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, you're getting an estimate of what you might be able to. You can calculate your mortgage qualification based on income, purchase price or total monthly payment. Pre-qualification assesses how much money you can borrow before applying for a home loan. Your loan officer quickly analyzes your income, assets, and credit to. Enter a purchase price or total monthly payment the calculator will determine the gross annual income required to qualify for the purchase. Lender consider all debts for both borrowers when two people apply for a mortgage as co-applicants. If one of the borrowers owns a home then the monthly. Use the home affordability calculator to help you estimate how much home you can afford Results in no way indicate approval or financing of a mortgage loan.

Best Way To Build Stock Portfolio

Some different investment portfolio examples include mutual funds, exchange-traded funds (ETFs) and index funds. These are all great ways to introduce. Mutual funds or exchange-traded funds (ETFs) are often a great way to gain access to a wide range of asset classes. Stocks provide growth potential, but can be. Investing doesn't have to be complicated or costly to be successful; simple & inexpensive is most effective. I invest % in total-market. Building a profitable investment portfolio isn't complicated - as long as you set realistic investment goals. In most cases, diversification turns out to be a. Figure out how often you want to invest: weekly, monthly or every paycheque. · When picking a dollar amount to invest, try to find a balance between stretching. But how exactly can you build one? Read on to learn more about different types of portfolios, why diversifying can be a good idea and how you can start building. How To Build a Stock Portfolio · 3. Pay to Read Stuff from Folks More Focused Than You · 8. Think Probabilistically · 9. Buy in Pieces · Sell Your Losers (and. Once you have decided how much of each asset class you'd like to invest in, the next step is to choose the specific shares of assets that will be in each of. The purpose of combining different asset classes is to be better prepared for various market conditions in an effort to provide more consistent, less rocky. Some different investment portfolio examples include mutual funds, exchange-traded funds (ETFs) and index funds. These are all great ways to introduce. Mutual funds or exchange-traded funds (ETFs) are often a great way to gain access to a wide range of asset classes. Stocks provide growth potential, but can be. Investing doesn't have to be complicated or costly to be successful; simple & inexpensive is most effective. I invest % in total-market. Building a profitable investment portfolio isn't complicated - as long as you set realistic investment goals. In most cases, diversification turns out to be a. Figure out how often you want to invest: weekly, monthly or every paycheque. · When picking a dollar amount to invest, try to find a balance between stretching. But how exactly can you build one? Read on to learn more about different types of portfolios, why diversifying can be a good idea and how you can start building. How To Build a Stock Portfolio · 3. Pay to Read Stuff from Folks More Focused Than You · 8. Think Probabilistically · 9. Buy in Pieces · Sell Your Losers (and. Once you have decided how much of each asset class you'd like to invest in, the next step is to choose the specific shares of assets that will be in each of. The purpose of combining different asset classes is to be better prepared for various market conditions in an effort to provide more consistent, less rocky.

For example, if your asset allocation involves having 60% of your money in stocks or equities, you should diversify your portfolio to include foreign and. One of the first steps in investing is building a portfolio that's right for your situation. A portfolio is a mix of stocks, bonds and cash. How to build your investment portfolio · Identify the different elements of a diversified portfolio · Invest in funds · Diversify even within the same asset class. Step 1: Determining Your Appropriate Asset Allocation · Step 2: Achieving the Portfolio · Step 3: Reassessing Portfolio Weightings · Step 4: Rebalancing. Do you want to build your own stock portfolio? Here are 13 not-so-easy components you should consider. Investing doesn't have to be complicated or costly to be successful; simple & inexpensive is most effective. I invest % in total-market. How you divide your total portfolio into stocks, bonds and cash investments will influence your total returns greatly. Over the long-term, stocks have provided. Know your objectives · Choose the right level of risk · Select your investments within each asset · Rebalance your portfolio and review your strategy. An all-ETF portfolio means giving up actively managed mutual funds, which have the potential to outperform index ETFs through professional selection of stocks. How To Build An Investment Portfolio: 6 Important Steps · Determine your risk tolerance and investment time horizon · Decide how active you want to be · Choose an. One of the quickest ways to build a diversified portfolio is to invest in several stocks. A good rule of thumb is to own at least 25 different companies. The key to building a sustainable stock portfolio is diversification. In other words, you'd spread your money across several: Stocks; Industries; Asset types. Diversify your portfolio. No matter how well a stock might be doing at the moment, the price and value of stocks are bound to fluctuate. Diversifying your. How to Build a Stock Portfolio in the Stock Market · 1. Your goals. Determining your goals is the first step to creating a stock portfolio. · 2. Asset allocation. 1. Develop investment goals · 2. Determine your appetite for risk · 3. Work out the right investment for your risk appetite · 4. Build and monitor your investment. However, this is not usually the best way to build a smart portfolio. Instead, seek out a wide range of stocks from different industries, and also diversify. Growth portfolios are designed to build up an increase in returns over time, through individual stocks growing in value and through the reinvestment of. The first factor is where you're at in your investor life stage – early investing years, good earnings years, higher income and savings years, early retirement. 7 clever and reliable stock market investing tips: · Avoid the risk of ruin · Invest in what you care about · Be humble & try to learn from your. Set Clear Goals:Define your financial goals, such as retirement, buying a home, or funding education. Your goals will influence your investment.

What Credit Score Do Need To Buy A Car

For a new car loan, any FICO score over about will get you the best credit deal offered. It no longer matters for this specific purpose if your score is. In , the average credit score for a new car loan was and the average credit score for a used car loan was Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories. Most lenders require a credit score of at least to qualify for a traditional car loan. Every borrower falls into a specific credit score category. What Credit Score Do You Need to Finance a Car? Lenders generally require a minimum credit score to finance a car loan, but that's not a hard and fast rule. An average new car buyer has a credit score of around For used car buyers, the average hovers around What Credit Score Do I Need To Buy a Car? Your best odds of securing a conventional car loan are with a credit score of over However, if your score is. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able. A score of or less is deemed too low to be given a loan. The CIBIL score is based on your payment history across loans and credit cards. For a new car loan, any FICO score over about will get you the best credit deal offered. It no longer matters for this specific purpose if your score is. In , the average credit score for a new car loan was and the average credit score for a used car loan was Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories. Most lenders require a credit score of at least to qualify for a traditional car loan. Every borrower falls into a specific credit score category. What Credit Score Do You Need to Finance a Car? Lenders generally require a minimum credit score to finance a car loan, but that's not a hard and fast rule. An average new car buyer has a credit score of around For used car buyers, the average hovers around What Credit Score Do I Need To Buy a Car? Your best odds of securing a conventional car loan are with a credit score of over However, if your score is. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able. A score of or less is deemed too low to be given a loan. The CIBIL score is based on your payment history across loans and credit cards.

Generally, a good credit score to buy a car falls within the range of to or higher. However, it's important to note that each lender has different. However, lower credit scores often result in higher interest rates, and you'll need to rely on other factors—like having a steady income—to secure a loan. What. Average Credit Score to Finance a Car. The target credit score for securing a car loan is or above. · How to Get Car Financing With Bad Credit · Learn More. An average credit score of at least is needed to finance a new car, and for a used vehicle, you'll need a score of Generally speaking, banks require a minimum credit score of to give an auto loan without any down payment. However, you CAN buy a car with a score of or. What credit score is needed to finance a car? Most lenders are looking for scores above , but those with bad credit can get car finance. Technically, there is no minimum credit score needed for an auto loan. However, the lower your credit score, the higher your interest rate and vice versa. If. Credit Score to Finance a Car: What to Expect · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to The average credit score for financing a car, truck, or SUV is in the high s for a used car and the high s for a new car. What's the Average Credit Score to Finance a Car? The average credit score of drivers who have been approved for auto loans in is for a new vehicle and. Generally % down and max loan amount of k depending on the lender. Will need 2 years job at the same place, or at least in the field. For best rates, you need + FICO score (not credit karma vantage). So if you have the option, you can get it higher for better interest rates. The minimum credit score for a car loan approval is around You'll get better loan terms though if your credit score is anywhere between to What Credit Score is Needed for a Car Loan for a Used Vehicle? · – – % · – – % · – – % · – – % · – – %. Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. When you apply for a car loan, auto dealers may pull from either your VantageScore or FICO score, both of which have slightly different ranges for what is. What's the Average Credit Score to Finance a Car? The average credit score of drivers who have procured auto loans as of was for a new vehicle and The average credit score to finance a car is , but it's just an average. Plenty of drivers around Madison fall under that number and plenty around Clinton. Experian reported that for the fourth quarter of , the average new-car loan rate for scores of at least was only about 1 percentage point higher than. Most lending institutions require at least a credit score to approve an auto loan without a downpayment. However, it is possible to purchase a vehicle.

Weyerhaeuser Stock

Weyerhaeuser Co. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Weyerhaeuser Co. engages in the manufacture, distribution and sale of forest products. It operates through the following business segments: Timberlands; Real. Stock quote, interactive chart, historical stock price, investment calculator, dividend information, proposed dates, history, tax information, transfer agent. According to 7 analysts, the average rating for WY stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. According to 6 Wall Street analysts that have issued a 1 year WY price target, the average WY price target is $, with the highest WY stock price forecast. WY - Weyerhaeuser Co. - Stock screener for investors and traders, financial visualizations. Weyerhaeuser Co WY:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date03/28/24 · 52 Week Low · Weyerhaeuser Company Declares Dividend on Common Shares. Jul 25, Sustainability at Weyerhaeuser. Stock Data. NYSE: WY. $ Last Price. -$ Discover real-time Weyerhaeuser Company Common Stock (WY) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Weyerhaeuser Co. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Weyerhaeuser Co. engages in the manufacture, distribution and sale of forest products. It operates through the following business segments: Timberlands; Real. Stock quote, interactive chart, historical stock price, investment calculator, dividend information, proposed dates, history, tax information, transfer agent. According to 7 analysts, the average rating for WY stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. According to 6 Wall Street analysts that have issued a 1 year WY price target, the average WY price target is $, with the highest WY stock price forecast. WY - Weyerhaeuser Co. - Stock screener for investors and traders, financial visualizations. Weyerhaeuser Co WY:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date03/28/24 · 52 Week Low · Weyerhaeuser Company Declares Dividend on Common Shares. Jul 25, Sustainability at Weyerhaeuser. Stock Data. NYSE: WY. $ Last Price. -$ Discover real-time Weyerhaeuser Company Common Stock (WY) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

The closing price is not indicative of future price performance. Historical Stock Prices are provided for informational purposes only and are not intended for. At Weyerhaeuser, we're proud of what we do and how we do it, and we invite you to learn more. Weyerhaeuser Company is an American timberland company. The company also manufactures wood products. Stock price history for Weyerhaeuser (WY). Weyerhaeuser stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. WY Stock Forecast FAQ Based on analyst ratings, Weyerhaeuser's month average price target is $ Weyerhaeuser has % upside potential, based on the. Weyerhaeuser (WY) real time stock quotes, news, chart, key statistics and vital financial information with AInvest. Stock analysis for Weyerhaeuser Co (WY:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. See the latest Weyerhaeuser Co stock price (WY:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Weyerhaeuser (WY) has a Smart Score of 5 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. View Weyerhaeuser Company WY investment & stock information. Get the latest Weyerhaeuser Company WY detailed stock quotes, stock data, Real-Time ECN. Real time Weyerhaeuser (WY) stock price quote, stock graph, news & analysis. Research Weyerhaeuser's (NYSE:WY) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. View Weyerhaeuser Company WY stock quote prices, financial information, real-time forecasts, and company news from CNN. PROFILE (WY). Weyerhaeuser Co. engages in the manufacture, distribution, and sale of forest products. It operates through the following segments: Timberlands. View today's Weyerhaeuser Company stock price and latest WY news and analysis. Create real-time notifications to follow any changes in the live stock price. Discover historical prices for WY stock on Yahoo Finance. View daily, weekly or monthly format back to when Weyerhaeuser Company stock was issued. Weyerhaeuser Company (at-time.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Weyerhaeuser Company | Nyse: WY | Nyse. Is Weyerhaeuser (NYSE:WY) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company. Historical daily share price chart and data for Weyerhaeuser since adjusted for splits and dividends. The latest closing stock price for Weyerhaeuser. Weyerhaeuser Company (US:WY) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC).

Can You Cash A Check Into Cash App

But with our mobile app, getting the funds you need can be easier and more convenient than ever. Keep up with your account on the go and apply straight from. Check cashing with us is quick, convenient, reliable - and it can save you money. Find a nearby Baker's Money Services Desk today for all your check cashing. You can deposit a check directly through the Cash App — and the better news is that it's more convenient than going to a bank once you know how to do it. Enter the amount you're depositing. Add a memo if you like. If it all looks good, swipe the Slide to Deposit button to confirm. How do I make a deposit by cashing a check at a financial service center (location offering check cashing, payday loans, money transfers)? · How fast will my. The traditional process of cashing cheques requires taking your cheque to the bank, filling out a deposit slip, waiting in line for a teller, and then standing. It's on the first page with your balance. Scroll down to the bottom, you should see "Checks - Scan with your phone". You can cash a check in the PayPal app by taking a photo of both sides of your signed check and choosing when you want to receive the money in your PayPal. You can receive up to $25, per direct deposit, and up to $50, in a hour period. Cash App makes direct deposits available as soon as they are received. But with our mobile app, getting the funds you need can be easier and more convenient than ever. Keep up with your account on the go and apply straight from. Check cashing with us is quick, convenient, reliable - and it can save you money. Find a nearby Baker's Money Services Desk today for all your check cashing. You can deposit a check directly through the Cash App — and the better news is that it's more convenient than going to a bank once you know how to do it. Enter the amount you're depositing. Add a memo if you like. If it all looks good, swipe the Slide to Deposit button to confirm. How do I make a deposit by cashing a check at a financial service center (location offering check cashing, payday loans, money transfers)? · How fast will my. The traditional process of cashing cheques requires taking your cheque to the bank, filling out a deposit slip, waiting in line for a teller, and then standing. It's on the first page with your balance. Scroll down to the bottom, you should see "Checks - Scan with your phone". You can cash a check in the PayPal app by taking a photo of both sides of your signed check and choosing when you want to receive the money in your PayPal. You can receive up to $25, per direct deposit, and up to $50, in a hour period. Cash App makes direct deposits available as soon as they are received.

With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes in your bank. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. We may hold all or a portion of the funds deposited with the service. Any hold times and amounts will be displayed within the USAA Mobile App at the time of the. You can add money from checks directly to your Reloadable Target Circle Card Account using the Mobile Check Capture feature in the mobile app on your iPhone® or. Yes, you can deposit a check on Cash App. To deposit a check on Cash App, you will need to have a verified account and a linked bank account. Our store locations can help you cash a wide range of check types. From payroll checks, government issued checks, tax refund checks, money orders, two-party. Select Cash App users can deposit a paper check using the Mobile Check Capture feature. If the feature is available to you, you can deposit your check in just. Walmart will charge a $ fee for each card cashing transaction. This fee is in addition to any fee(s) charged by the issuer of the card & will be deducted. Check cashing can be completed in person at a local branch or deposited using your bank's mobile app. Banks aren't obligated to cash checks for individuals who. You can't put or add money on your Cash App Card at an ATM since ATM deposits on Cash App Cards are not supported. You can load money onto your. The Cash a Check feature in the PayPal app (also referred to as remote check capture, mobile check cashing, or check reload) allows you to deposit checks on. We cash many types of checks at Check Into Cash. It's the fast and easy way to get your cash and go. Visit us today for hassle-free check cashing services. Accept cash, checks, and other tender with the Square app. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime. We are your local check cashing store with more than 2, Money Services locations. · No need for enrollment, so you can receive your money instantly. · Cash. What are the minimum and maximum check amounts I can add with Mobile Check Capture? Checks added via Money in Days must be in an amount between $ and. Cash checks on a mobile device anytime, anywhere. Get your money in minutes in your bank, PayPal, and prepaid card accounts. But with our mobile app, getting the funds you need can be easier and more convenient than ever. Keep up with your account on the go and apply straight from.

Best Rates For Cd Investments

Compare CD Accounts on Raisin ; Prism Bank · % ; Ponce Bank · % ; Dayspring Bank · % ; Sterling Federal Bank · % ; Ponce Bank · %. Historically, even the most generous CD rates have often been outpaced by other investments. It's easy to see why CDs are such a tempting investment today. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Quontic Bank — 6 months -. The best CD rates right now are above 5%. CD rates track the federal funds rate—the interest rate commercial banks charge each other to borrow money. When the. If you're interested in making monthly or recurring deposits, a High Yield Savings Account (HYSA) is probably a better choice for you. With a CD, your funds are. Certificates of deposit (CDs) can be a good choice when you want steady, predictable investment income that is federally insured The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. FDIC-Insured Certificates of Deposit Rates ; month, N/A ; 3-year, % ; 4-year, % ; 5-year, %. FDIC-Insured Certificates of Deposit Rates ; 3-year, % ; 4-year, % ; 5-year, % ; 7-year, N/A. Compare CD Accounts on Raisin ; Prism Bank · % ; Ponce Bank · % ; Dayspring Bank · % ; Sterling Federal Bank · % ; Ponce Bank · %. Historically, even the most generous CD rates have often been outpaced by other investments. It's easy to see why CDs are such a tempting investment today. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Quontic Bank — 6 months -. The best CD rates right now are above 5%. CD rates track the federal funds rate—the interest rate commercial banks charge each other to borrow money. When the. If you're interested in making monthly or recurring deposits, a High Yield Savings Account (HYSA) is probably a better choice for you. With a CD, your funds are. Certificates of deposit (CDs) can be a good choice when you want steady, predictable investment income that is federally insured The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. FDIC-Insured Certificates of Deposit Rates ; month, N/A ; 3-year, % ; 4-year, % ; 5-year, %. FDIC-Insured Certificates of Deposit Rates ; 3-year, % ; 4-year, % ; 5-year, % ; 7-year, N/A.

The best CD rate on a 1-year CD is % APY from EagleBank. You can open an online CD if you do not live near a branch in Maryland, Virginia, or Washington, DC. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %. Current CD Rates. CD TERM, $1,$24,, $25,$,, $, and over. 5-Month, % APY*. 's Best Credit Union CD Rates – Editor's Picks ; 1-year CD, Elements Financial CD, % ; 3-year CD, Farmers Insurance Group Federal Credit Union CD, %. Alliant Credit Union offers CD terms ranging from three to 60 months, earning up to % APY. There's a $1, minimum deposit required for all CDs. Alliant. As of August 27, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. New Issue CD Rates (% APY) ; 1-Year Ladder. (4 CDs). 3 mo ; 2-Year Ladder. (4 CDs). 6 mo ; 5-Year Ladder. (5 CDs). 1 yr. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. As part of an overall cash investment strategy, brokered CDs often offer a set interest rate with FDIC coverage that may be subject to limits. According to the FDIC, the average month CD rate today is %. However, many banks currently offer rates of 4%–5% or more, especially for terms under two. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Alliant Credit Union. % APY. ; EverBank (formerly TIAA Bank). % APY. ; National average for 3-month CD. %. ;» See more best 3-month CD rates ; CURRENT. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates · PenFed CD Rates · CIT. The best CD rate on a 1-year CD is % APY from EagleBank. You can open an online CD if you do not live near a branch in Maryland, Virginia, or Washington, DC. These rates are often below % APY and will vary by the amount invested. Should I buy a CD now or wait? In a high-interest rate environment. Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %.

Price To Put In An Inground Pool

The investment for an inground fiberglass pool spans a broad spectrum, typically ranging from $40, to upwards of $,, influenced heavily by the pool's. How much it costs to build an inground pool in Minneapolis St Paul of Minnesota depends on the pool materials, size, shape, location and its surroundings. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Pool Size Cost Factor · 16x30 vinyl liner pool with a concrete deck $33,, 20x40 -$40, · 16x30 gunite pool with a concrete deck $60,, 20x40 - $70, Pool package prices typically range between $65,–$, for fiberglass styles (see the What's Included page to view everything included in our standard. The typical range for inground pools is between $28, and $55,—it works out to cost about $50 to $ per square foot. While the average price of a basic. To give an idea of how much a 12×24 pool might cost in Texas, without knowing much more of course, would start between $30, and $70, Of course your size. According to estimates from at-time.ru, the average cost in the United States for installing an in-ground swimming pool is between $35, and $65, An average inground swimming pool costs $ to install while most pay Estimating the price to build a pool depends on the size and. The investment for an inground fiberglass pool spans a broad spectrum, typically ranging from $40, to upwards of $,, influenced heavily by the pool's. How much it costs to build an inground pool in Minneapolis St Paul of Minnesota depends on the pool materials, size, shape, location and its surroundings. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Pool Size Cost Factor · 16x30 vinyl liner pool with a concrete deck $33,, 20x40 -$40, · 16x30 gunite pool with a concrete deck $60,, 20x40 - $70, Pool package prices typically range between $65,–$, for fiberglass styles (see the What's Included page to view everything included in our standard. The typical range for inground pools is between $28, and $55,—it works out to cost about $50 to $ per square foot. While the average price of a basic. To give an idea of how much a 12×24 pool might cost in Texas, without knowing much more of course, would start between $30, and $70, Of course your size. According to estimates from at-time.ru, the average cost in the United States for installing an in-ground swimming pool is between $35, and $65, An average inground swimming pool costs $ to install while most pay Estimating the price to build a pool depends on the size and.

The installation costs of above ground pools usually run $$3,, depending on the size and type of pool. Keep in mind that oval pools normally cost more to. According to estimates from at-time.ru, the average cost in the United States for installing an in-ground swimming pool is between $35, and $65, Depending on the type of material you choose, you'll spend anywhere from $20, to $65, or more to install a pool. The wide range reflects three in-ground. Rectangular vinyl pools are the least expensive, with an average cost of $40, to $70, for a 12'x20' pool. Rectangular pools are the easiest to install. According to at-time.ru, the average cost of installing an inground pool is between $35, and $63, Costs vary depending on the size, material. On average, inground swimming pools cost anywhere from $50 to $ per square foot to install, and that's without any upgrades. There are also other add-ons to. Although pool prices will vary from region to region in the country, a typical base inground pool cost starts at around $ – $ in most areas. $, to $, is the general price range for an inground swimming pool. However, if you choose not to have a deck installed for your above ground pool. Here at California Pools & Landscape, our Standard Pool starts at $55, For example, the identical, basic 15 x foot pool and its features may have a starting base price of $45, in Phoenix or Tampa—and $75, in Raleigh or. The average above-ground pool kit costs $2,–$7,, depending on the quality. Rectangular inground pools with a deck can cost over $10, Inground vinyl. According to industry estimates, the average cost of an inground pool installation is around $35, However, this figure can range from $28, to $70, Depending on the pool type, costs can range from $ to $ Check out our rundown of prices you can expect, from installing a pool to maintenance. On average be prepared to spend at least $45,$ to build your inground pool. Companies like precision pools and spa can provide you with a custom quote. This comprehensive cost guide will help you understand the expenses associated with an inground pool by examining different aspects. This guide will walk you through the various types of inground pools available, their costs, and other critical considerations to ensure you make an informed. How much is that investment? While lifelong memories with your family are priceless, the average cost for a backyard renovation ranges from $50, and can go. The cost of building a pool in Houston can vary based on several factors. While our pools in Houston start around $45,, they can range up to $, or more. Indoor pools. An indoor swimming pool will cost you much more than the outdoor options. Often, contractors charge between $ and $ per square foot. The.

1 2 3 4 5 6 7